By Pete Ryan

3 minute read

It’s time to face the music. Sh*t has hit the fan. We're experiencing the 3rd most significant Nasdaq downturn in 20 yrs, dropping 34% over the last year. It’s not 2001 or 2008 levels, but it isn’t good.

How did we get here?

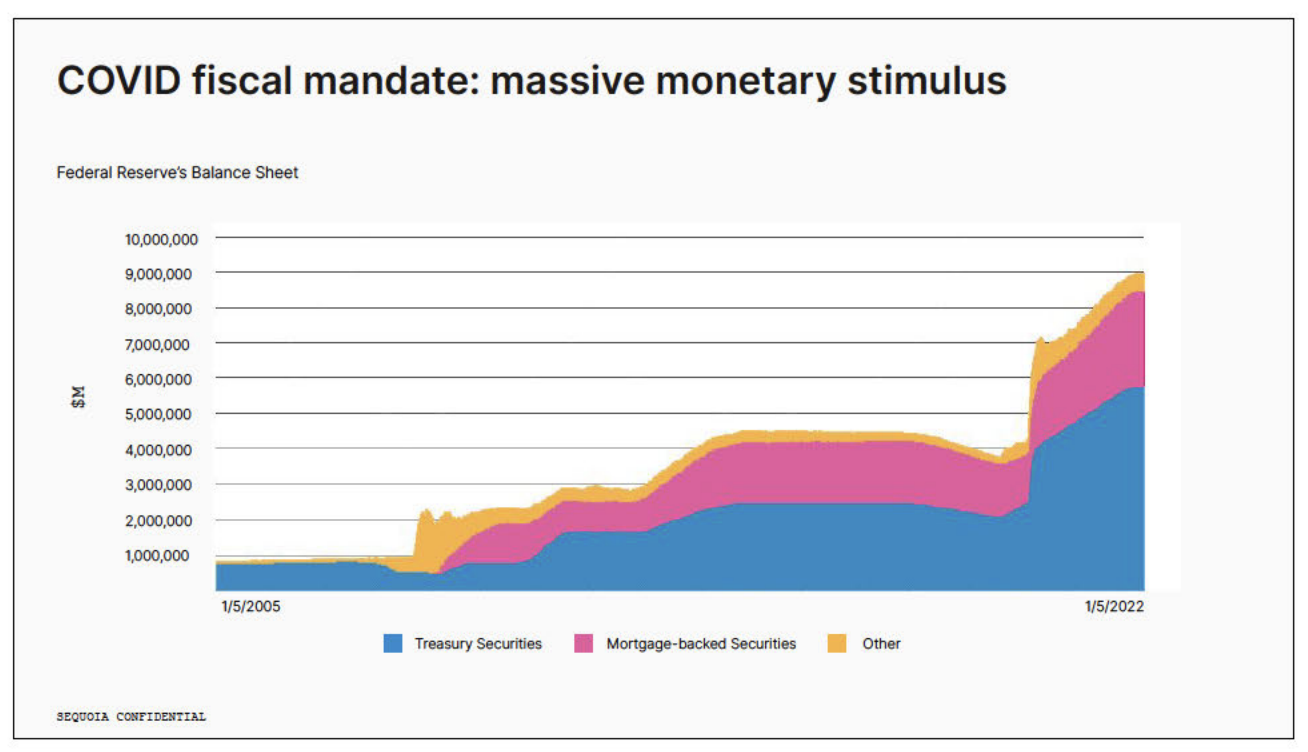

COVID-19 hit, and massive monetary stimulus packages were rolled out to prevent a recession, but now it’s all come crashing down.

Aside from the noticeable effects on people's lives, the pandemic has profoundly impacted the economy and financial markets. One of the most notable casualties has been the technology sector, which has sharply declined. More than 60% of all software, internet, and fintech ‘companies are trading below their pre-pandemic 2020 stock prices. Are the financials of most tech companies all that bad? Not really. Many tech companies are doubling revenue and profitability.

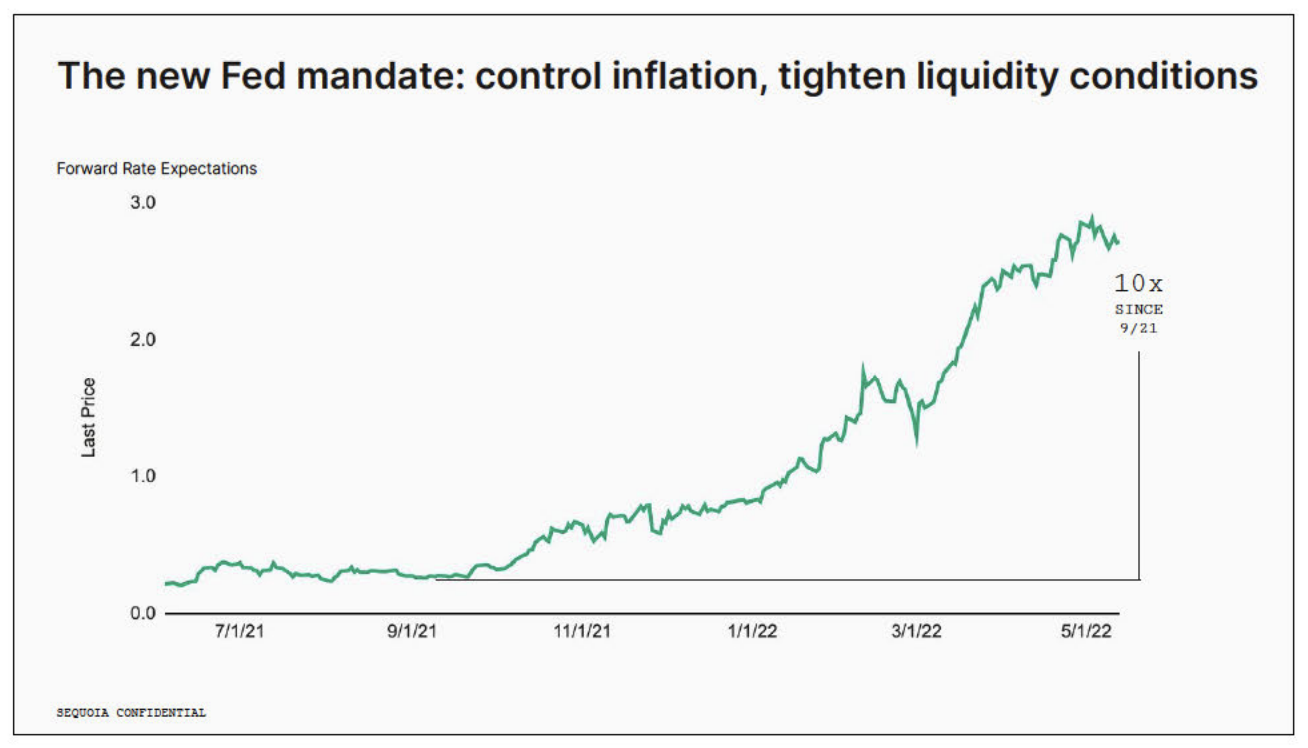

Inflation has hit record levels, the highest in decades. The government has been trying to control inflation by raising interest rates and using other monetary policy tools. Still, these efforts have kept the inflation rate unchanged so far.

As an investor, you are looking for companies that can produce near-term certainty and future upside potential. In other words, you want to invest in companies with a solid track record of success and a bright future. There are many ways to measure a company's success, but one of the most important factors today is profitability. Another is the (LTV:CAC ratio), which measures the relationship between the lifetime value of a customer and the cost of acquiring that customer.

So are we actually in a recession or approaching a recession?

To avoid becoming a statistic, it’s essential to understand the early warning signs of a looming recession and take action accordingly.

Here are four key indicators that a recession may be on the horizon:

- Rising interest rates: One of the first things to watch out for is an increase in interest rates. This can ripple effect on the economy, making it more difficult for consumers to borrow money and limiting business investment.

- Decreasing housing prices: Another critical indicator of a recession is a decrease in housing prices. This can result from several factors, including rising interest rates and a decrease in demand.

- Decreasing stock prices: A third key indicator of a recession is a decrease in stock prices. This can be caused by several factors, including decreasing company profits, political instability, and increasing interest rates.

- Increasing unemployment: A fourth key indicator of a recession is increasing unemployment. This can be caused by several factors, including decreasing company profits and business investment.

To be frank, we see all of these indicators taking place in our economy. As a founder, taking action quickly is essential to keep your company alive.

You need to cut costs, get creative with pricing, raise more money (if you can), and find more profitable ways to go to market.

Taking these steps can help ensure your business remains afloat.

As mentioned in The End of Sales and Marketing-Led Growth: What You Need to Know, the CAC with sales-led and marketing-led GTM strategies has gone up a great deal (60% over six years). Unfortunately, over the next few years, it will only get harder to grow profitability.

Many companies are looking at product-led, community-led, partner-led, and relationship-led as new channels for growth. Depending on the state and stage of your business, you should be exploring to determine which of these new innovative GTM strategies make the most sense for your business.

Looking at your funnels is more crucial than ever in today's market. By understanding your customer's buying journey, you can create a sales funnel that leads them through purchase.

Many companies are looking to relationship-led selling to accelerate their growth. Depending on the state and stage of your business, you should be exploring to determine which of these new innovative GTM strategies make the most sense for your business.

If you're not sure where to start, our team can help. We have a wealth of experience in developing and executing sales funnels for companies of all sizes. Let us know how we can help you today.

Posted November 8, 2022

Join the relationship-led movement

Get introductions with our relationship-led Chrome extension