By Pete Ryan

2 minute read

Today, founders are constantly seeking GTM growth opportunities, and one such avenue that has gained significant traction in recent years is the utilization of advisors.

These advisors, often industry veterans or experts in their field, bring valuable insights, connections, and guidance to startups navigating the tumultuous waters of entrepreneurship.

Traditionally, advisors were compensated with equity in the company, aligning their interests with the venture's success. Founders have long recognized the benefits of offering equity to advisors. It incentivizes them to contribute to the company's growth actively and fosters a sense of ownership and commitment. Advisors, in turn, leverage their networks and expertise to open doors, make introductions, and provide strategic counsel.

However, as the startup landscape evolves, so must the dynamics of these advisor relationships.

With the proliferation of startups and the subsequent abundance of startup equity, the perceived value of advisory shares has diminished. The harsh reality is that most startups fail, leaving advisors with little more than lottery tickets in exchange for their time and expertise.

As a result, advisors are seeking more tangible forms of compensation.

At Hifive, we've recognized this shift firsthand over the last 36 months after speaking with hundreds of founders, investors, and advisors.

Our experience has taught us that while advisory shares are still valuable, they are no longer sufficient on it's own.

Advisors crave more than just a potential payout in the distant future; they want immediate and tangible rewards for their contributions.

Enter Hifive's Connector Directory—a revolutionary concept that redefines the startup-advisor relationship. Instead of relying solely on equity, founders now have the opportunity to compensate advisors monetarily for their services.

Our directory features Super Connectors, who offer various services, from making introductions and promotional posts on social media platforms to sponsoring newsletters and providing consulting hours.

This innovative approach recognizes the inherent value that advisors bring to startups.

Their insights, connections, and influence are often more valuable than traditional marketing channels. After all, what good is a well-crafted ad campaign or SDR program if it doesn't convert?

By investing in building an army of Connectors, founders can tap into a vast network of potential customers and partners in a targeted and cost-effective way.

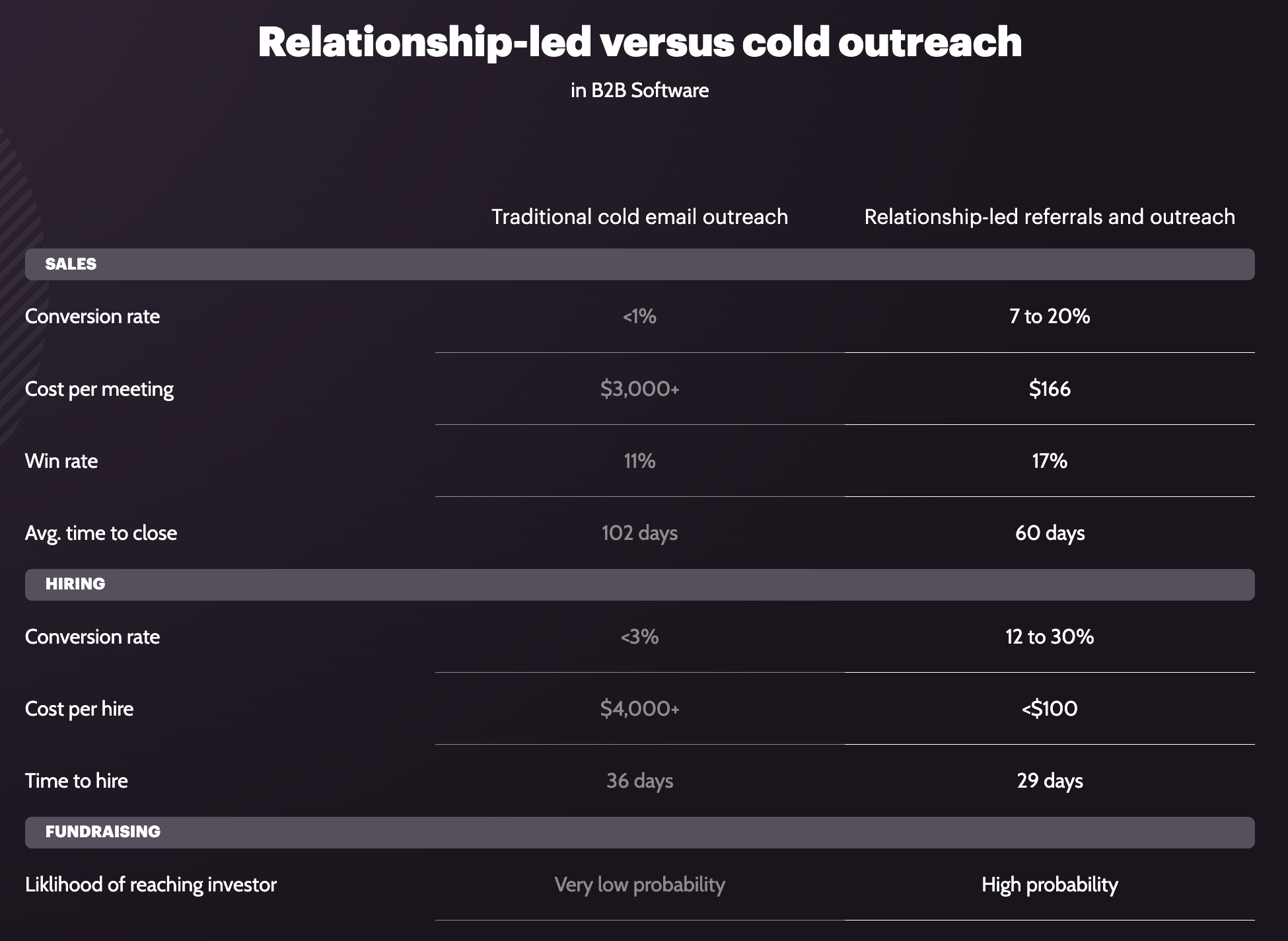

Instead of pouring resources into conventional marketing tactics like ads, cold outreach, and events, founders can leverage the power of influence and introductions to gain a competitive edge in their respective markets.

The reality is that few startups are capitalizing on paying their advisors and Connectors.

By embracing this new paradigm and prioritizing the value of advisor services, founders can differentiate themselves from the competition and accelerate their growth trajectory.

So, how much should you offer your advisors?

The answer lies in their value and services. With the Hifive Connector Directory, Connectors tailor compensation packages based on market (supply-demand) dynamics.

Either way, the ROI of taking the path of Relationship-led Growth over cold outreach is very clear.

The future of startup-advisor relationships is evolving. While equity will always have its place, founders must adapt to the changing dynamics of the startup landscape.

By embracing new compensation models and prioritizing the value of advisor services, startups can gain a competitive advantage and propel themselves toward success in an increasingly crowded market.

Posted March 21, 2024

Join the relationship-led movement

Get introductions with our relationship-led Chrome extension